Fixed cost is an essential part of accurate profit projections for every business, regardless of its size. As such, it is included in the calculation of cost of goods sold. These costs for some businesses—for example, manufacturing companies—will be much more substantial than those for other businesses. Examples of this could include, sole proprietorships doing independent consulting. However, these costs will need to be calculated accurately in order to set appropriate prices for products and services. If there’s not enough margin to cover the costs, the company will end up in the red. We all know that’s not what any business owner is looking for.

Fixed Cost Definition

What is fixed cost? It is a business expense that stays constant, regardless of the volume of revenue produced in a business. It occurs at regular intervals. For instance, weekly, monthly, or annually, it occurs at a fixed rate, and it increases in a step function.

These are commonly referred to as business overhead costs. These costs need to be paid regardless if sales are zero or $100M. While they vary from business to business, every business has them and needs to plan for them. Fixed costs are indirect expenses. This means they’re not directly related to the production of goods and services. A company with high fixed costs will need to produce higher revenue to compensate for those costs.

Typically, high fixed cost businesses aim to drive volume growth over price growth, since an increase in volume doesn’t proportionally increase costs. If you’re working with a client, understanding whether they operate in a primarily fixed or variable cost business is a good early thing to check.

[optin-monster slug="oa6kdflxsmp4bi4azzgi" followrules="true"]

Fixed Costs vs. Variable Costs

The other kind of costs normally incurred in the production of products and services are variable costs. These costs may be one-time expenses, or they may be recurring costs that change according to how many products or services you produce. Variable costs are directly related to production. For instance, wages are variable; salaries are not. Wages depend on the number of hours your employees end up needing to work while salaries remain constant. The materials required to produce your product are a variable expense, as are one-time expenditures. And example would be sub-contract labor, that is required to complete the production.

Fixed Cost Examples

Fixed costs are ongoing expenses incurred in a business, even if those costs increase or decrease now and then. The following types of expenses provide examples:

- Advertising and Marketing: Some advertising costs will largely stay the same. For example, website hosting and social media management will usually be charged as recurring costs at the same rates.

- Depreciation and Amortization: The amounts written off to account for the depreciating value of machinery, equipment, buildings.

- Insurance: Premiums for business-related insurances recur in regular intervals and amounts.

- Property Taxes: Real estate taxes are assessed at regular intervals and only change when the value of the real property changes.

- Rent or Mortgage: Most businesses will need to pay rent or mortgage payments for real estate. Even home-based professionals will need to calculate the business portion of their rent or mortgage in their costs.

- Salaries: Unless the business is a sole proprietorship, salaries paid at set rates, regardless of hours worked, will be a fixed expense.

- Vehicle Payments: If the company purchases or leases a vehicle, the payments will be the same for the term of the loan.

Average Fixed Cost

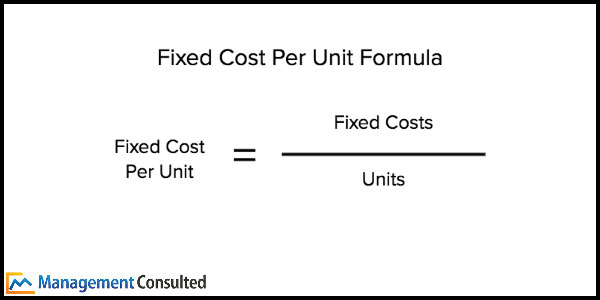

When calculating the cost of goods sold, your total fixed costs will need to be averaged and assigned to the units produced (known as Total Fixed Cost Allocation). This is then added to your variable costs to determine the true cost per item. The electricity bill, warehouse lease, and business liability insurance aren’t going away any time soon, but they will be affecting your profit margin. Use the following formula to determine your average fixed cost.

Fixed Cost Per Unit Formula

First, determine the total of your fixed costs. An easy way to do this is to browse through your profit and loss statement. Identify all the costs that are the same and recurring, such as the examples above. Once you’ve added these up, divide that amount by the number of units produced and you’ll have the average fixed cost per unit. For example, if a manufacturing company produces 50 widgets that it sells for $1,000 each and the total fixed costs for the company total $5,000, the average fixed cost comes out to $100 per widget. (Now, isn’t that a beautiful profit margin?)

Conclusion

A thorough evaluation of both your fixed costs and variable costs will help you evaluate the true cost of goods sold. Fixed costs, even though they are indirect expenses, are part of that calculation. A regular analysis of your real costs will help you identify which levers you need to pull in your business. Ultimately, this kind of analysis will help keep your margin well above the red line. Now go forth and make money!