Are we headed for a recession? In addition to everyone’s concern for the health of their loved ones, the coronavirus has people everywhere wanting to know if a recession is coming in 2020 and beyond. However, if you’re the kind of person who pays attention to financial news, you were probably wondering about the possibility of a recession long-before the COVID-19 pandemic.

Since the tail end of the Great Recession, markets have seen an unprecedented amount of expansion. The US experienced a record-breaking 121 straight months of growth—that’s a decade-long bull market. But no bull market lasts forever. Starting in the second half of last year, more and more investors began to anticipate a recession expected to slow the economy in 2020 or 2021. The global slowdown in response to the coronavirus pandemic, has made those expectations all but guaranteed. Let’s take a look at what exactly a recession is and how we know when one is coming. After that we’ll look into what kinds of effects a recession will have on the economy, and on consultants & consulting firms in particular.

What is an Economic Recession?

The meaning of a economic recession is one of those things we might think most people agree about. But if you asked ten different economists, you’d probably get ten slightly different answers. The National Bureau of Economic Research—a private, nonprofit, non-partisan organization—offers a good general definition: “A significant decline in activity spread across the economy, lasting more than a few months, visible in industrial production, employment, real income, and wholesale-retail trade.” But that still invites the question: how do we know for sure when a national or even global recession is happening or is going to happen?

This refers to what economists call recession indicators. Not everyone agrees on what signs and metrics are the most reliable recession indicators. But there are a few indicators most economists and investors pay some attention to. Some of the safest indicators include real GDP and real income (the ‘real’ here means the effects of inflation are taken out of the figures involved). When GDP and individual incomes fall consistently over a period of at least several months, it could mean a recession is coming or has arrived.

Other recession indicators include the productivity of the manufacturing sector, manufacturing and wholesale retailers’ sales figures, and the yield curve. The ‘yield curve’ refers to the interest rates for 2- and 10-year treasury bonds. Historically, the ‘inversion’ of the yield curve to negative interest rates has been an indicator of a recession. The yield curve inverted for the first time since the Great Recession on August 14, 2019. This is what first got so many investors to start predicting an economic recession.

[globalcta id="CTA-Resume-Question-v1"]

So Is a Recession Coming in 2020?

After the inversion of the yield curve last year, many analysts’ predictions for the likelihood of a recession in 2020 increased. Yet, there was no widespread agreement. However, many of the events that have transpired in 2020 now make a recession all but guaranteed.

The most obvious of these is the widespread outbreak of the coronavirus/COVID-19. The pandemic is grinding the global economy to a halt as governments are shutting down all unnecessary activity. Simply put, the measures governments have taken to slow the virus’ spread are making a global recession and economic contraction highly likely. The only question now is how deep the recession will cut and how long it will last.

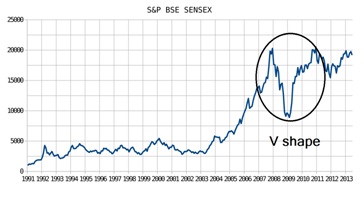

Some analysts remain optimistic that the virus will soon be contained, and that the economy will be able to bounce back. Some recessions result in a V-shaped recovery, in which pent-up demand allows markets to recover with growth just as rapid as the initial contraction.

Challenges To A Quick Recovery

Unfortunately, there are some reasons why a V-shaped recovery is unlikely to happen with this recession. For one thing, the longer the recession continues, the longer recovery will take. Some estimates suggest that the coronavirus will keep the economy stalled for up to 18 months as governments await the development of a vaccine. In that time, many companies are likely to go bankrupt. Further, some are predicting that unemployment may exceed even the worst periods of the Great Depression. Though, many predictions never come true. Governments and central banks have some ability to cushion the worst effects of a recession, but they can’t prevent it entirely. For those reasons, a"U" shaped recovery seems more plausible at this point.

The United States has its own disadvantages. The government’s ability to provide greater relief and stimulus was hindered by large budget deficits, the country’s ongoing trade war with China, as well as the recent deterioration of global oil markets. Further, all of these factors have increased the likelihood of a liquidity crisis, as investors become more risk-averse and capital exits the lending markets. The difficulty of obtaining credit will only increase the number of companies that fail over the course of the recession.

How Could a Recession Impact Consulting Firms?

Many individuals will be looking for recession-proof jobs. If you’re a current or aspiring employee of a consulting firm, you’re sure to be wondering how the global recession will impact consulting. Historically, consulting firms seem to perform relatively well in both times of expansion and times of recession, though they may experience a slowdown within the first several months as newly threatened companies look to cut costs.

Recessions are obviously very hard on most companies, forcing many to look for outside help in order to stay afloat. Struggling companies may be inclined to bring on consulting help in order to cut all possible operating expenses and shore up revenues. Further, they may enlist consultants’ help in navigating government stimulus. Or, they want help adapting to new markets as a survival mechanism. In short, recession forces businesses to get creative in order to avoid bankruptcy, and this is where consultants can help.

Also, not all businesses suffer in times of recession. For some, recession is an opportunity to acquire new assets. During a recession, profitable companies may bring on consultants to help form strategies for new Mergers & Acquisitions, especially as the price of acquisition drops.

How Should Consulting Candidates Prepare?

What are you supposed to do if you’re an aspiring consultant trying to find employment during a deepening recession? Because consulting jobs are so appealing at this time, they only become more competitive. This only puts more pressure on applicants to maximize their competitiveness. Consulting candidates should invest heavily in interview prep, optimize their resumes, and deepen their knowledge of current economic affairs.

Some aspiring or current consultants may even decide this is a good time to go to business school. If you don’t have an MBA, getting one is likely to make you a more competitive applicant. Plus, higher education has historically been a haven for people looking to ‘hide out’ from a stalled economy.

[globalcta id="CTA-Interview-Landingpage"]

Conclusion

The coronavirus is a once-in-a-century natural disaster, something no one could have been fully prepared for. The one certainty right now is that everyone is facing the same uncertainty. Most recession indicators tell us to expect the economy to experience a contraction in the coming months. We don’t know how severe, or exactly how long it’s going to last. One thing that’s clear is that businesses are going to have to do everything they can to survive. For many, that’s likely to mean continued reliance on outside consultants.

Additional Reading:

- Liquidity Crisis Looms: What Businesses Can Do Now

- Coronavirus Economic Impact On Consulting

- Consulting Resume: Complete Guide