The GE McKinsey Matrix is an excellent tool. It allows organizations to conduct effective portfolio planning based on the strength and industry attractiveness of each business unit. This nine-box matrix was created by McKinsey in the 1970s to help General Electric (GE) determine how to best invest in their business units. The GE McKinsey Matrix helped GE prioritize not only where to focus their money, but also time, talent, and energy. Let’s jump right in and see how it could benefit a business.

What Is the GE McKinsey Matrix?

Similar to BCG’s well-known growth share matrix, but more comprehensive, the GE McKinsey Matrix offers a “systematic approach for the multi-business corporation to prioritize its investments among its business units.”

It is becoming increasingly difficult to determine which products and services to invest in and which ones to retire. This is given that the organizations of today often have (too) many products. It is almost impossible to continue to maximize profitability with the product/service mixes many organizations currently offer. The GE McKinsey Matrix provides a unique and helpful perspective to help organizations determine where to invest and where to pull back.

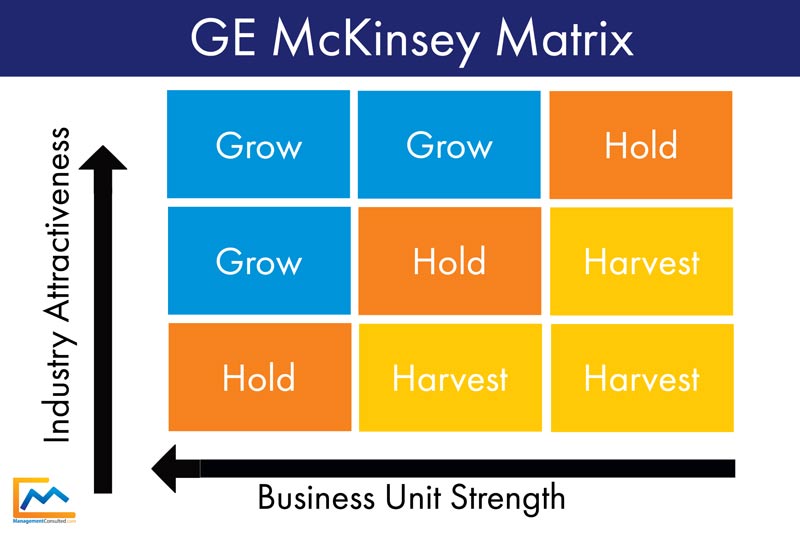

For reference, see below for an example of the GE McKinsey Matrix:

This tool is also known as the GE McKinsey Nine Cell Matrix or the McKinsey GE Stoplight Matrix. It's approach to evaluating products, services, and business units takes into account two main attributes:

- The strength of a business unit/product

- Industry attractiveness

The strength of a business unit or product is evaluated on how well the business unit is competing in a particular market. Evaluating the strength of a business unit is broken down to include the following factors:

- Market penetration

- Market share

- Brand strength

- Profitability

[optin-monster slug="oa6kdflxsmp4bi4azzgi" followrules="true"]

Industry attractiveness focuses on external market factors. Industry attractiveness can be challenging to ascertain because of the volatility of certain markets. Also because of the disruption that is happening at warp speed across industries. Industry attractiveness may be evaluated based upon the following:

- How many competitors are in the market?

- What is the market share by competitor?

- Is the overall market growing?

- What are the average gross margins on a particular product/service industry-wide?

- What are the barriers to entry in this market?

GE McKinsey Matrix Template

We're providing a GE McKinsey matrix templates online, which you can use to help your clients – or internal team - build the matrix.

The McKinsey matrix template is available in an Excel template (external link).

GE McKinsey Matrix Example

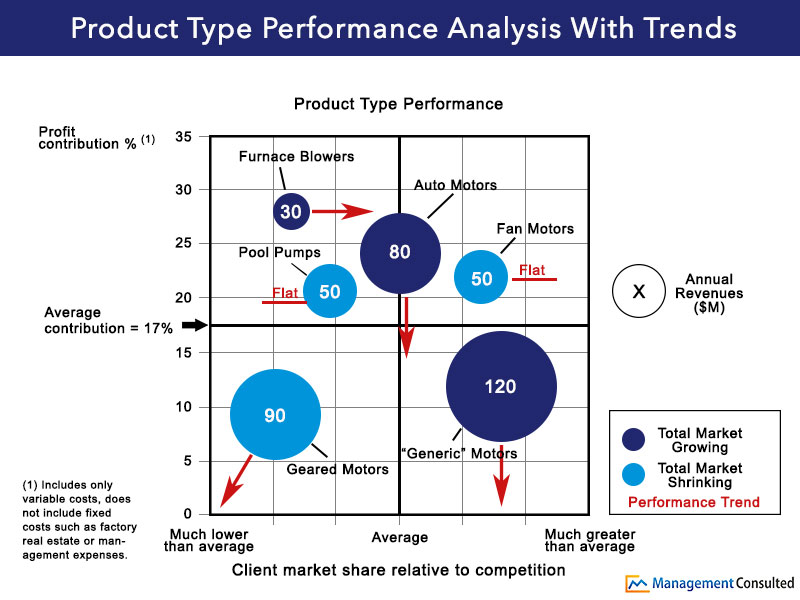

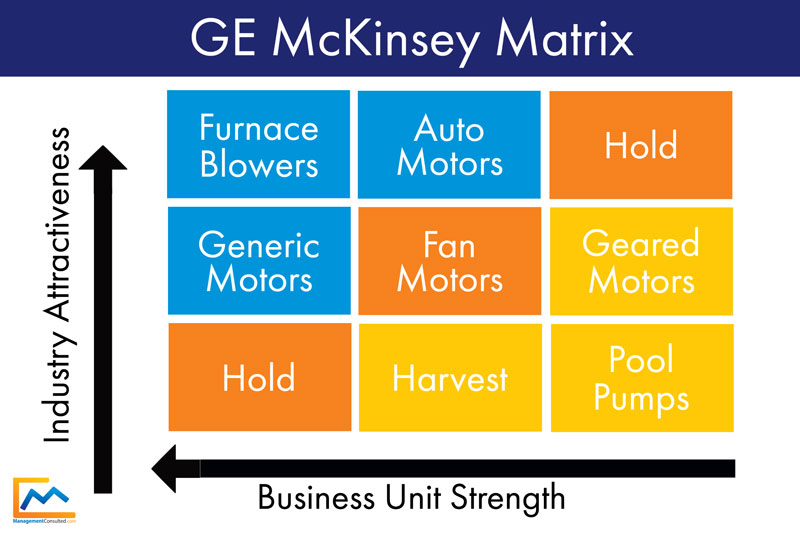

There are many examples where we can apply the GE McKinsey Matrix. Take the manufacturer in bankruptcy represented in the graphic below:

By applying the GE McKinsey Matrix, it is clear that our client in bankruptcy has some immediate decisions to make. Once you calculate the contribution margin of each division and apply the matrix criteria, the choices become simple.

There are some divisions we could justify multiple options for – they key thing to recognize here is that by applying the criteria of the GE McKinsey Matrix, we can decide what to do with each division.

Note: remember, our manufacturer is in bankruptcy. That means their #1 need is cash – now!

How To Apply The Matrix

Each business unit is placed on the matrix according to its competitive ability and attractiveness of its industry. Additionally, both present and future state are assessed before a decision is reached on where to categorize a business unit on the matrix.

If a business unit is strong by our predetermined KPIs, and in an attractive industry, it makes sense to continue to invest.

If a business unit is profitable, but with low/medium market share in a growing market, it makes sense to continue to invest.

Though, if a business unit is a market share leader, but in a shrinking market, you may want to divest ASAP. The indication is that the business unit will never be worth more than it is today. Plan B would be to enjoy the cash flow, but pull extra investment easing further investment into the unit.

Conclusion

Helping organizations determine how they should focus their cash and energy is often one of the first requests consulting firms receive. The GE McKinsey Matrix builds on what is offered by the BCG Matrix by providing a clear picture of a company’s priorities.

As a consultant, the McKinsey Matrix will prove invaluable in helping your clients navigate investment and divestment decisions. It will also be a helpful tool as you navigate the case interview – to get expert coaching from a former MBB consultant, work one-to-one with the MC Team!

Additional Reading:

- Promote Job Openings to MC's >1M-strong community

- BCG Matrix

- McKinsey Frameworks

- Utilizing SWOT In A Business Case

- Consulting vs Internal Strategy