![]()

Marakon is a “boutique” consulting firm with a long history who prides itself on having pioneered “value-based management” way back in the 1990s. Marakon used to be much larger and more successful, particularly prior to its bankruptcy and subsequent purchase by Charles River Associates in 2009. That bankruptcy, however, was driven more by partner profit sharing, ownership, and management issues than loss of relevance in the market. Many clients and former employees consider the firm a “hidden gem” that “punches above its weight.”

Most Marakon projects are interesting and tend to be very strategic in nature, which is not always the case at many MBB strategy consulting firms. A former colleague graduated from Kellogg and spent two frustrating years at Bain doing M&A integration work. That won’t happen at Marakon (not to say you should seek employment at Marakon over Bain, however).

Marakon employees are motivated and smart. At this stage in its history, it’s a pretty small firm. It still hires from Ivy League or similar schools, and subsequently almost everyone you meet will be impressive. Should you pass up a job at McKinsey, Bain, BCG, or Deloitte to work at Marakon? Of course not. But there are many better-known brands in the management consulting space (e.g., Accenture, LEK, etc.) that could in fact be worse, perhaps much worse, places to start your management consulting career.

Why is this? Because the strategic nature of the projects, opportunities for rapid skill development and learning, and pace of progression are all very attractive.

Before continuing to learn more about what Marakon is today, let’s proceed with a brief history lesson.

Marakon Consulting Key Stats

- Marakon Website: http://www.marakon.com/

- Marakon Headquarters: Boston, MA

- Marakon Employees: 50 consultants

- Marakon Locations: Boston, Chicago, Houston, London UK, New York

- Marakon Chief Executive: Mason Kissel

- Marakon Revenue: $25M

- Marakon Engagement Cost: ~$150K

Marakon Associates History

Marakon was founded in the 1970s and was at the forefront of “value-based management”.  This is the practice of managing a company to maximize its value to shareholders (based on a belief – now much less accepted - that this is the best route to maximize its value to all stakeholders). Its founders wrote a book called The Value Imperative that was required reading at the firm for decades. One of its authors and one of the most senior partners at Marakon for decades, Michael Mankins, is currently a senior partner at Bain.

This is the practice of managing a company to maximize its value to shareholders (based on a belief – now much less accepted - that this is the best route to maximize its value to all stakeholders). Its founders wrote a book called The Value Imperative that was required reading at the firm for decades. One of its authors and one of the most senior partners at Marakon for decades, Michael Mankins, is currently a senior partner at Bain.

One of the core pillars of Value-Based-Management, or VBM, was that accounting profit is an imperfect measure of the financial success of a company. This is because it doesn’t account for how much capital is invested in it. So, Marakon was on the forefront of encouraging companies to adopt “economic profit” or “economic value added” as a performance metric. Through the 1980 and 1990s, many of Marakon’s projects were large-scale “transformation” efforts. Projects with 10+ consultants (or more), ripping apart a company’s financial statements to understand economic profit by product, customer, business segment, etc. From there, it would work with the management team to explain the “EP” that was being created. This would be a function of either a good market (positive market economics) or a strong competitive position. The “client” was almost always the CEO of a large, Fortune 500 company looking for ways to “double the value” of his or her enterprise.

In a typical Marakon project in the 1990s, around 6 months into a project, after a detailed financial and strategic fact-base was complete, various strategic alternatives would be evaluated and their potential impact on the company’s stock price and shareholder value would be determined. These projects were long term, involved many resources, and were highly profitable for the firm. At its height, Marakon was a >$100M+ company. In the late 1990s, the Vault Guide to Consulting would often list Marakon as a top 10 firm.

By the 2000s, due to a variety of factors, the firm faced difficult times. Value-based management was becoming both more “commoditized” with more consulting firms capable of helping firms adopt its key principles. At the same time, the premise behind a pure focus on shareholder value was increasingly challenged. Around this time, some of the firm’s original founders retired, creating equity and ownership issues. Some partners also left to start their own firms or join places like BCG, Bain, or McKinsey.

Between 2000 and 2010, the remaining partners “disaggregated” the “VBM offer” to help clients with particular strategic needs, such as customer value management and organic growth, M&A, business unit strategy, or portfolio management. In 2007/2008, the firm tried to merge with a small investment bank, an effort that did not pan out.

In ~2009, Charles River Associates, an economic consulting and litigation firm, purchased Marakon out of bankruptcy to help build a management consulting arm. Marakon exists as a business unit and separate brand within the CRA family, and there is not a lot of crossover and sharing of clients.

Marakon Consulting Practice Areas

Marakon is definitely a “strategy” consulting firm more than it is a “management” consulting firm. It addresses issues of strategy, or where and how to compete. However it will at times, dive into how to execute a strategy via blueprints and action plans. It is less focused on how to organize, and certainly does not do much “operational” consulting work.

Marakon has evolved into a boutique strategy consulting firm that maintains clear linkages to its past focus on strategy development for a CEO audience. But it now also has specific “lower level” offers and a recent focus on the Oil and Gas and Financial Services verticals.

It is structured around its offices in Boston, Chicago, Houston, New York, and Marakon Associates London (UK), with New York working with a disproportionate number of financial services clients, and Houston focused on Energy.

Marakon major practice areas include:

- Strategic advisory – this is all about helping companies choose where and how to compete at a high level. It is the “pure strategy” that links back to the firms roots.

- Value capture – this is about helping companies implement strategies by developing action plans and blueprints.

- Even-driven advisory – this is about helping companies react to major issues like recessions, drought, competitor product launches, etc.

Strategic advisory, however, is at Marakon’s core.

Industries

When it comes to industries, Marakon’s Houston office is more focused on Energy and New York serves many financial services clients. Overall, the firm plays in these industries:

But Marakon is not like big firms where industry focus might mean you become a true expert in a given industry and only work within that industry for years. At Marakon, certain partners seem to work with more clients in a certain industry. If you align with one such partner, you may work on more clients in that industry. But this process is informal.

Marakon Career Path

First, let’s focus on your career at Marakon, and then discuss where you might head after that.

A typical Marakon career path is one of the factors that, in our view, differentiates it from the broader pool of small boutique firms out there. The firm hires at both the undergraduate and MBA level, but has never been great at integrating MBA hires. That’s the bad news. But the good news is, the reason it doesn’t integrate MBA hires all that well is partially because of the trust in and opportunities it affords to many of its undergraduate hires.

Marakon Associates does have a policy of paying for graduate school for top employees. It also is OK promoting and hiring its undergraduate hires to post MBA roles, at full post MBA salaries. That is, if they demonstrate the ability to perform in post MBA roles. And oftentimes, opportunities to demonstrate this ability are provided without hesitation. Project teams often have, in the past, seen undergraduates with 4-5 years of experience working alongside or even informally managing MBA hires. That is just the culture of the firm.

So for a motivated undergraduate without an offer from an MBB consulting firm, Marakon could be a place to learn a ton quickly and progress rapidly. It's possible to get to a point where your Marakon salary is $115K per year, just a few years out of school. And, whether you are an undergraduate hire or an MBA level hire, odds are, your projects will be generally strategic in nature and involve working with senior clients on impactful projects. You may work long hours, but you’ll probably be learning a lot.

Marakon is one of those places that a Bain, McKinsey, or BCG might respect if your goal is to jump to a firm like that. Many Marakon alumni find their way to top business schools. Of course, jumping to industry via a client or recruiter is a very common path as well.

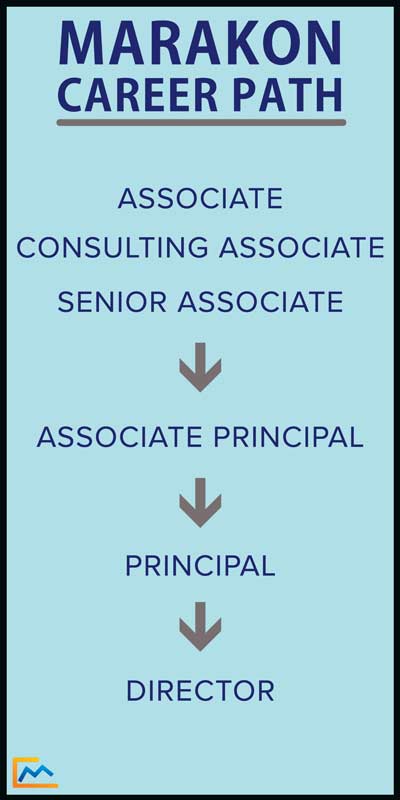

Undergrads are hired as Associate or Consulting Associate (leading analysis). MBAs are hired as Senior Associates (leading workstreams). The career path from there continues on to Associate Principal (managing clients), Principal (leading the teams), and eventually Director (firm leader).

Marakon Consulting Culture

Interestingly, going back decades, Marakon has maintained a two night per week travel model. For the most part, you leave on Tuesday AM and return on Thursday, which is a significant improvement upon the Monday or even Sunday to Thursday model at other firms. But still, there are long hours and you bond with colleagues as a result.

Outside the office, the Marakon culture varies by office, but could generally be described in the admittedly trite phrase “work hard play hard.” Associates do often form close friendships, probably as a result of the long work hours and shared travel experiences. While the firm could be considered very intellectual, there is also a lot of drinking and “partying” after hours. In this though, Marakon is probably not unlike many other boutique or large management consulting firms.

There are frequent happy hours at Marakon, and whether a Principal or Director attends events like this varies based on the individual. But in general, outside the office, the firm makes an effort to create opportunities for fun – including a mixture of happy hours, events for families, etc.

Marakon Consulting Recruiting

Marakon, at time of this writing, does not have an official internship program. Though, it does randomly take on interns at both the undergraduate and graduate level. It helps, however, to have a contact at the firm. It typically recruits for undergraduates and sometimes MBAs at more selective schools. Historically, they would conduct on campus interviews at Northwestern for the Chicago office, as well as Duke and Wharton for the New York or Boston offices. As the firm has gotten smaller, however, there is less regular recruiting.

The interview process is typically very case-study heavy with an initial round consisting of one initial fit interview and one case study, completed on campus. A second round of interviews typically involves 3-4 case studies with slightly more senior employees, and then a “fit” interview with a partner. This happens about a week later. Sometimes, offers are made after these two rounds. In other cases, a third round is conducted (but this is rare).

The case studies you’ll see are all typically individual, standard case studies about the attractiveness of a market, the strategic alternatives available to a firm, or how to improve profitability. Inside each case study there is usually a section where the interviewer pauses to ask some questions that require you to size a market to check your comfort with quantitative information. And, whether you already know or can quickly understand very basic accounting ideas like profit vs. loss and fixed vs. variable costs is frequently tested within the cases as well.

Marakon Consulting Salaries

Roughly, Marakon pays incoming associates a ~$70,000 base + 15% max performance bonus, on top of 401K matching, benefits, and the like. To check the most current salary figures, check our Management Consulting Salary Report. Our salary report is updated annually with data from real offers.

Consulting associates earn closer to $90,000, and Senior Associates (post-MBA entry level) are closer to $120,000. The starting Associate Principal salary is in the $160,000 range, and Directors earn well over $200,000. From that initial 15% bonus target, the percentage target payout increases to ~30% at the Associate Principal level.

Conclusion

All things considered, if you don’t have a route into a top firm like McKinsey or BCG, but you have the option to work at Marakon, you could do a lot worse. Particularly if you are looking to do more strategy development work and less operational consulting in an environment where you might be given lots of responsibility quickly, Marakon Consulting is a great place to build a consulting career.

Additional Reading:

- McKinsey versus Marakon: The Battle Between Global Management Consulting Firms and Boutiques

- MBB: McKinsey, BCG, Bain- Are They Really the Best?

- Consulting Firm Directory