Value creation makes or breaks a business model. It is the key metric that investors, shareholders, and other stakeholders look at when they consider long term returns. But the term itself is somewhat broad. Value is ultimately in the eye of the beholder, and the value creation definition has changed in recent years. Specifically, the modern investor is looking not only for profits, but also for societal impact separate from a firm’s bottom-line. In this article we’ll unpack value creation and think about who actually captures value once it is created.

Value Creation Definition

Your college economics textbook will tell you the value creation definition is taking inputs (resources, capital) and turning them into outputs (outcomes, profits). For an output to be valuable, there needs to be a stakeholder that values a given firm’s output. This can be the tricky part as firms start up, even if they go on to be huge successes. For example, think of Starbucks. The founders had to convince investors that the Starbucks brand could turn coffee from commodity to premium beverage. Today of course, thousands of people queue up, willing to pay $5 or more for coffee. As we’ll see momentarily, willingness to pay is a very important part of value creation. You can read about it in more detail here. But going back to Starbucks, how exactly do they elevate coffee into the premium category? The answer lies in their value creation model.

[optin-monster slug="oa6kdflxsmp4bi4azzgi" followrules="true"]

Value Creation Model

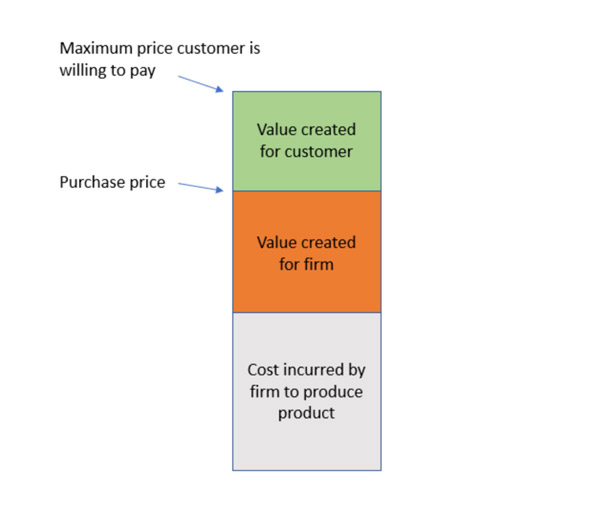

The value creation model lies at the intersection of the firm’s capabilities and the customer’s needs. Let’s break it down. A firm incurs costs to produce its product. Starbucks needs to buy the coffee beans, the coffee grinder, the flavoring, and the plastic cups. Then the firm sets a price for its product. Starbucks needs to charge at least 1 cent more than the cost of the cup of coffee. Otherwise, profits would be zero!

Firms need to make a profit of course, and they want to charge as much over cost as they can. How much over? That’s where customer needs come in. The price Starbucks can charge depends on what customers are willing to pay. This is the million-dollar question firms must think about. Mathematically, the value to the firm is the difference between price and cost. And value to the customer? Think of it as the difference between actual price paid and the price a customer would be willing to pay. The bar chart below illustrates a simple value creation model.

Value Creation Vs Value Capture

The pricing scenario above starts to get at the core difference between value creation and value capture. We’ve described value creation – firms using resources to produce stuff that customers want. Such resources can include brand identity, efficient operations, proprietary technology, anything really. All that matters is that Starbucks imparts value that warrants a pricier cup of coffee. Naturally, value capture happens after the value has been created. Just like a farmer needs to harvest and sell a crop, Starbucks needs a barista to sell the coffee. Capturing value through sales sounds simple enough, but for certain business models, value capture is much more complex. Smartphone apps are a good example. Most apps are free to download, so they need other ways to capture value. Many apps do this through advertising or in-app purchases that appeal to the most active users.

Value Creation Strategies

So as a business, how can you keep economic value creation top of mind? The best value creation strategies focus on the principle that value is subjective. Yes, there is a mathematical equation for economic value. But remember – it all rests on what the customer thinks! Thus, the companies that create the most value are the ones that get into the heads of their customers. For a long time, customers really did just want low prices. Companies responded with lean operations and intense cost cutting to deliver those low prices. While that value creation plan still holds merit, customers today look for a whole lot more. Low prices, sure. But mission-driven cultures, sustainable supply chains, equitable governance, and commitment to social issues all sit high on the list too. This broader set of needs is known as stakeholder capitalism.

Conclusion

The beauty of economic value creation is that it transcends company size and industry. All businesses need to create value to stay alive and keep growing. Good businesses understand that. Even better businesses understand that we are in a pivotal time for value creation. Consumers have so many choices across every category, and they want much more than just financial value. On top of that, the pandemic is fundamentally changing the value creation game as we rethink “normal” everyday life. Some industries are becoming less relevant while others are surging. What won’t change? The underlying relationship between firm and customer. As long as firms stay resilient and innovative, there will always be value to be created and captured.

Additional Reading:

- Supply Chain: Keeping Business Moving

- Unit Economics: What Is It?

- Strategy vs Tactics: Key Differences and Uses

- Case Interview: Complete Prep Guide