![]()

When you think about Visa, you probably think “credit card.” If you’re a little bit savvier, you may think “credit card interchange” or “payment processor.” Or perhaps your mind wanders to the credit card points you’re accruing towards that next vacation! Okay, let’s reign things back in. Did you know that Visa boasts a consulting arm that provides payment consulting advisory services for its clients? Recently, the Visa Consulting and Analytics Group also rolled out a crypto advisory service (so much for “decentralized” finance!). But should you want to work inside the Visa Consulting and Analytics Group. Let’s explore further.

Table of Contents

- Visa Consulting and Analytics Key Stats

- Visa Consulting and Analytics Overview

- Visa Consulting and Analytics Careers

- Industries

- Example areas of focus

- Office locations

- Exit opportunities

- Diversity programs

Visa Consulting and Analytics Key Stats

Firm Website: https://usa.visa.com/partner-with-us/visa-consulting-analytics.html

Firm Headquarters: San Francisco, CA

Firm Number of Employees: 700+ employees (including consultants, economists, and data scientists)

Firm Number of Locations: 75+ cities

Firm Chief Executive: Alfred F. Kelly Jr.

Firm Revenue: $24.1B net revenue for Visa in fiscal year 2021 -- revenue not disclosed for Visa Consulting and Analytics group, though in Q2 2022, it was cited by the company as a “growth driver”

Visa Consulting and Analytics Overview

Again, Visa Consulting and Analytics is the payments consulting arm for Visa. The group leverages Visa’s advisory experience, economic intelligence, data and analytics ability, and subject matter expertise to provide actionable payment strategies for clients.

Visa Consulting and Analytics’ findings are informed by the company’s breadth of payment data (e.g., credit card transactions). The amount of data available to the group (literally trillions of transactions) is really its point of differentiation.

For example, based on Visa credit card data, the Visa consulting team can fully benchmark client performance versus its peers and develop deeper, data-backed insights. For more information on the group, please see this video.

Visa Consulting and Analytics Careers

Like internships at other top consulting firms, the internship at the Visa Consulting and Analytics group is designed to mirror the experience of a full-time employee. Interns are staffed on consulting projects and are expected to take an active role in delivering the solution, mainly through data analysis, project management, and gathering requirements. While you will have some client exposure, stakeholder management is left to engagement managers and senior consultants.

Keep in mind that Visa consulting projects are not purely strategic in nature. While strategy may be a part of the scope of some engagements, the true value the Visa team brings to clients is in identifying data patterns and developing implementation plans.

Industries

Given Visa’s place near the center of the financial services industry, it’s clear where the Consulting and Analytics group’s focus lies. Clients may include:

-

- Credit card issuers

- Acquirers

- Financial technology companies

Visa Consulting and Analytics also supports merchants across industries. Generally, the outcome of these projects relates to increasing transaction volume and size, which benefits clients and the Visa organization.

Example Areas of Focus

Projects you will work on at Visa Consulting and Analytics include:

-

- Helping clients enable faster payments

- Supporting clients with e-commerce / digital strategy

- Helping clients with risk management strategies and fraud mitigation strategies while ensuring a pleasant customer experience

Visa also recently launched its Global Crypto Advisory project to help clients accept digital currencies and launch NFT projects.

Office locations

Visa has offices around the globe (offices span 6 continents) – no matter where you want to work in the world, there should be a Visa office close by. In addition, folks in the Consulting and Analytics practice generally have more flexibility as it relates to working remotely, at least for part of the workweek.

Exit Opportunities

Compared to the top consulting firms (McKinsey, Bain, and BCG), the external exit opportunities for Visa Consulting and Analytics will be more focused on the financial services industry or in the payments or crypto space. This is a stark contrast to MBB or strategy consulting, where the exit opportunities span every industry.

Following a stint at Visa, you will be an expert in payments and should be well positioned to land a job that requires payments subject matter expertise. In addition, you will have additional exit opportunities to move to a role within Visa where you have more ownership over a piece of the business (instead of advising other businesses).

Diversity Programs

Visa has a wide range of diversity programs (listed here), which reflects the breadth of diversity at the company. Groups for Visa employees include:

-

- Latinx Connect

- Military (MERG)

- Native American

- Parents & Caregivers

- Visa Asian Employee Network (VAEN)

- Visa Black Employees (ViBE)

- Visa Employees with Disabilities (Viable)

- Visa Indian Alliance (VINA)

- Visa Pride

- Visa Women's Network (VWN)

- Young Professionals at Visa (YP@V)

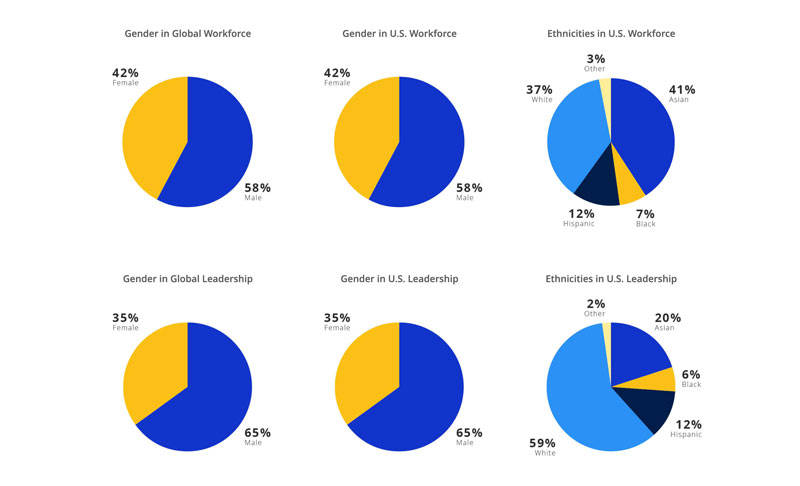

Visa also publishes the diversity of its workforce vis a vis the global workforce here. Findings from the analysis are below.

Conclusion

If you have a passion for payments or fintech yet still want a taste of the consulting life, the Visa Consulting and Analytics Group may be for you! Work with our expert team on resume edits and interview prep to put your best foot forward, and good luck!

Additional Resources:

- Top 25 Consulting Firms

- Boutique Consulting Firms

- Consulting Resume: Complete Guide

- Case Interview: Complete Prep Guide